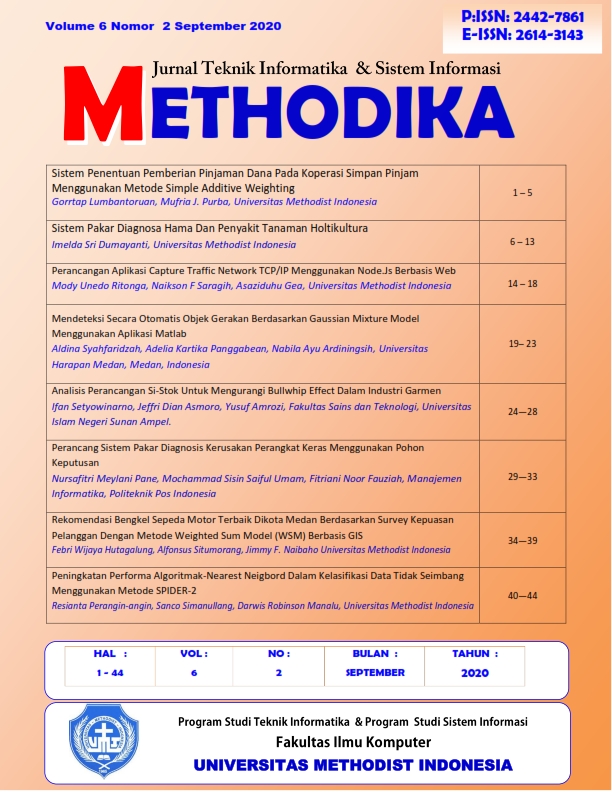

SISTEM PENENTUAN PEMBERIAN PINJAMAN DANA PADA KOPERASI SIMPAN PINJAM MENGGUNAKAN METODE SIMPLE ADDITIVE WEIGHTING

DOI:

https://doi.org/10.46880/mtk.v6i2.245Keywords:

Cooperatives, Multicriteria, Loans, Simple Additive WeightingAbstract

In providing loans, cooperatives have stages that must be passed before credit is decided to be disbursed. The aim is to facilitate cooperatives in assessing the feasibility of a credit application. The loan eligibility assessment is carried out with many assessment criteria including employment, income, capital/shares, number of dependents, and house status. Analysis of loan eligibility requires the accuracy of a credit analyst in analyzing credit applicants submitted by members. If the credit analysis is not precise, then the provision of credit funds can be difficult and even make a loss. So to determine whether a loan application can be accepted or not, of course, cooperative management has many multi-criteria considerations. In this study, an analysis was carried out using the Simple Additive Weighting method to facilitate the process of making feasibility decisions and eliminating lending to prospective debtors. The results of the study show that the results of the calculation of the determination of lending funds to members of savings and loan cooperatives using the simple additive weighting method can show alternatives that are eligible to receive loans with a preference value >= 60% and also alternatives that are not eligible to receive loans, namely with a preference value of <= 60%.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 Methodika

This work is licensed under a Creative Commons Attribution 4.0 International License.