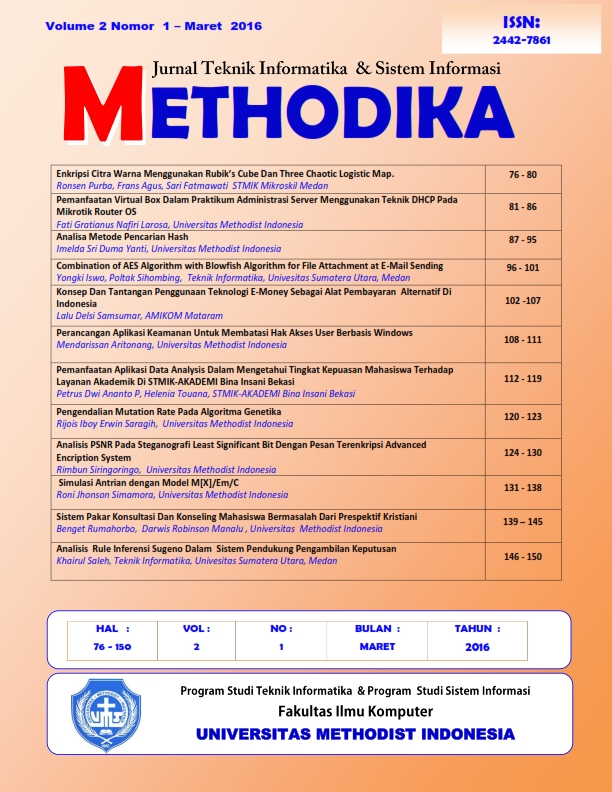

KONSEP DAN TANTANGAN PENGGUNAAN TEKNOLOGI E-MONEY SEBAGAI ALAT PEMBAYARAN ALTERNATIF DI INDONESIA

DOI:

https://doi.org/10.46880/mtk.v2i1.22Keywords:

e-money, e-money application in IndonesiaAbstract

The use of electronic money (e-money) in the next few years in Indonesia will grow significantly. With e-money, will

facilitate public transactions without the need to use cash. E-money is a non-cash payment instruments, these products save

some money value stored in the electronic equipment. Nominal money stored electronically done by exchanging a sum of

money or by debiting a bank account which is then stored in electronic equipment. Implementation of e-money in Indonesia,

including late if compared to countries such as Hong Kong and Singapore. E-money introduced since 2007, while in Hong

Kong in 1997 and Singapore in 2000. With the condition of the infrastructure in Indonesia, it takes a long time to people

accustomed to using e-money. Cultural society accustomed to transact in cash will be a challenge. To increase public

confidence, Bank Indonesia has issued a regulation with e-money transactions. The use of e-money will also facilitate the

public, because no longer need to carry cash. Transact using e-money is safe, because it uses technology that attention to

standardization such as the use of chips.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Methodika

This work is licensed under a Creative Commons Attribution 4.0 International License.